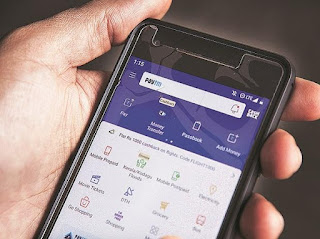

Dhanteras sale on Amazon, Flipkart, Snapdeal, Paytm: Know what is on offer

It is Dhanteras today, an occasion that marks the beginning of Diwali festival in India. Dhanteras is considered an auspicious day to buy precious metal. While there is no specific sale happening around the occasion, e-commerce platforms operating in the country like Amazon and Flipkart are running Diwali sales where one can avail offers and discounts on wide range of products, besides bank offers such as no interest equated monthly instalment and instant discounts. Let’s take a look at offers available on e-commerce platform: Amazon India Dhanteras sale Amazon is currently running its annual festive season sale named the ‘ Great Indian Festival sale ’ . Valid until November 13, the sale include wide range of products, including discounts on precious metals like Gold and Silver. Besides, there are bank offers to sweeten the deal; Amazon is offering 10 per cent instant discount on transaction made through State Bank of India credit cards subjected to minimum order value of Rs...