Reserve Bank tries to reduce NPA burden for lenders in coronavirus crisis

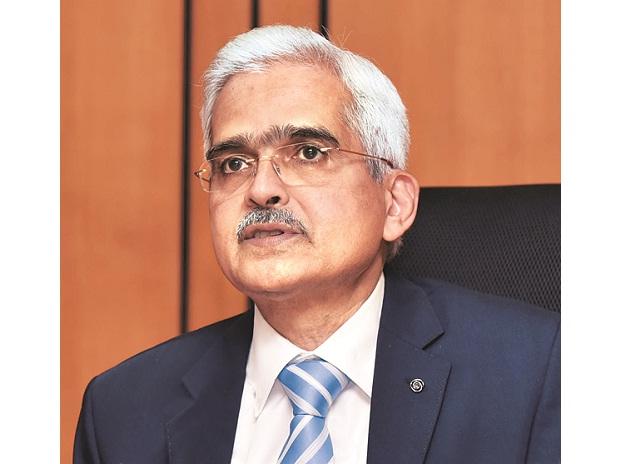

. The Reserve Bank of India (RBI) on Friday announced additional set of regulatory measures to reduce the burden of debt servicing due to disruptions caused by the coronavirus (Covid-19) pandemic, including an asset classification standstill for accounts that avail a moratorium between March 1 and May 31. Such accounts will, therefore, be classified as non-performing assets from 180 days of overdue, rather than the current norm of 90 days, according to a set of measures announced by RBI Governor Shaktikanta Das on Friday. “Economic activity has come to a standstill during the period of the lockdown, with consequential lingering effects which have unambiguously affected the cash flows of households and businesses,” the RBI said. On March 27, the RBI had permitted lending institutions in India to grant a moratorium of three months on payment of current dues falling between March 1 and May 31, 2020. Read More